Market Overview

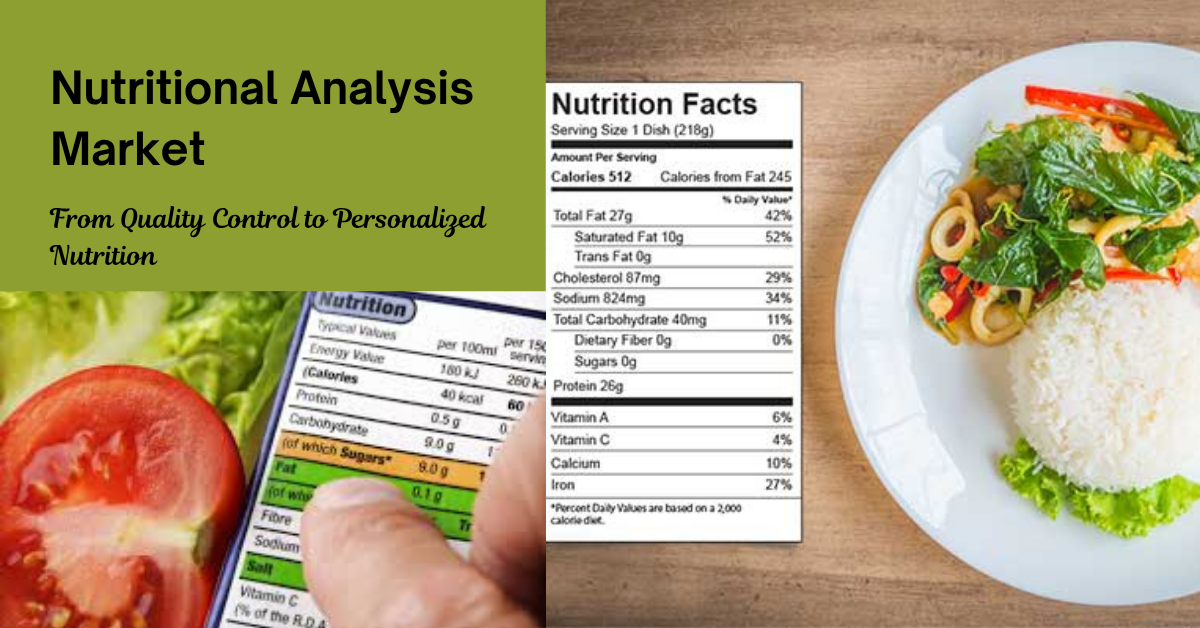

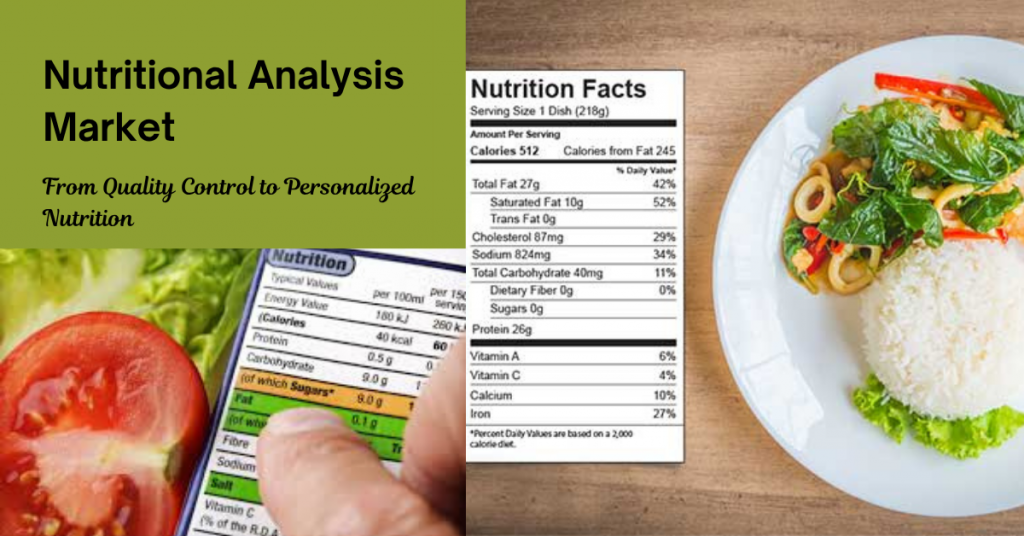

The Nutritional Analysis Market size was valued at USD 7,125.71 million in 2024 and is anticipated to reach USD 13,287.2 million by 2032, growing at a compound annual growth rate (CAGR) of 8.1% during the forecast period. This growth reflects the increasing global emphasis on health and wellness, driving demand for detailed nutritional information across various food products. Nutritional analysis serves as the backbone for quality assurance, regulatory compliance, and consumer trust in the food industry. As consumers become more health-conscious and regulatory standards tighten worldwide, the market for nutritional analysis is expected to witness robust expansion.

Nutritional analysis plays a vital role in enhancing food safety by identifying contaminants and ensuring products meet legal and safety standards. It also supports food manufacturers in product innovation and reformulation by providing precise data on nutrient content. In a market where transparency is increasingly demanded, nutritional testing acts as a critical tool for brand differentiation and maintaining consumer confidence. Moreover, the global rise in diet-related health conditions such as obesity and diabetes has propelled governments and private sectors to invest heavily in nutritional research and monitoring, further driving market growth.

The growing trend towards organic, clean-label, and plant-based foods is another factor fueling the nutritional analysis market. These products require comprehensive testing to verify claims related to nutrient content, absence of contaminants, and allergen presence. As food companies strive to meet these evolving consumer preferences, demand for sophisticated analytical technologies is on the rise. Additionally, nutritional analysis is becoming integral to personalized nutrition solutions, which tailor diets based on individual health profiles, further expanding market scope and applications.

Increasing global trade in food products also necessitates harmonized nutritional analysis to comply with varying international standards. Exporters and importers rely on accurate nutritional data to meet the regulatory requirements of different countries, ensuring smooth market access and reducing trade barriers. This aspect underscores the critical role of nutritional analysis in facilitating globalization of the food industry. Consequently, investment in advanced testing infrastructure and software solutions is becoming a priority for many stakeholders aiming to stay competitive in this dynamic market.

Read full report: https://www.credenceresearch.com/report/nutritional-analysis-market

Market Drivers

Increasing Consumer Awareness

Consumers today are more informed about nutritional content and health implications, leading to heightened demand for transparency. This awareness compels food manufacturers to conduct thorough nutritional analysis to comply with labeling standards and meet customer expectations. Social media and digital platforms amplify consumer knowledge, increasing scrutiny of product claims and authenticity. Brands that provide clear and accurate nutritional information gain a competitive edge, fueling the need for reliable testing methods. Moreover, health-conscious trends such as keto, vegan, and gluten-free diets increase the complexity of nutritional testing. These evolving consumer demands push the market toward innovative solutions and enhanced analytical capabilities.

Regulatory Compliance and Standards

Governmental bodies globally are implementing stringent regulations around food labeling and safety. Compliance with these regulations mandates regular and accurate nutritional testing, driving the demand for analytical services and equipment. For instance, regulations by agencies like the FDA, EFSA, and FSSAI require detailed nutrient profiling, allergen testing, and contaminant analysis. Non-compliance can result in hefty fines, product recalls, and loss of consumer trust. Increasing focus on traceability and transparency also compels manufacturers to adopt rigorous testing protocols. Consequently, regulatory frameworks act as a strong catalyst for market growth by enforcing accountability in the food supply chain.

Technological Advancements

Innovations in analytical techniques such as chromatography, spectroscopy, and software solutions are improving the speed and precision of nutritional testing. These technologies enable detailed profiling of food components, supporting market growth. Portable devices and real-time testing methods are reducing turnaround times, enhancing operational efficiency. Integration of AI and machine learning with analytical instruments allows for predictive insights and improved data interpretation. Software platforms streamline data management, ensuring compliance and facilitating decision-making. These technological advancements are lowering barriers to adoption and expanding the scope of nutritional analysis across industries.

Growth in the Food & Beverage Industry

The expanding global food and beverage industry, especially in emerging economies, requires comprehensive nutritional analysis to ensure quality and safety. New product development and diversification further augment the market demand. Rising consumer preference for functional and fortified foods compels manufacturers to validate health claims through detailed nutrient analysis. The surge in demand for packaged and processed foods also drives the need for consistent quality control. Additionally, increasing international food trade necessitates adherence to diverse nutritional standards, pushing companies to invest in reliable testing solutions. Overall, this growth trajectory in the food sector is a key driver for the nutritional analysis market.

Market Challenges

High Cost of Advanced Analytical Equipment

The adoption of sophisticated analytical technologies requires substantial capital investment, which can be a barrier for small and medium-sized enterprises. High initial costs coupled with maintenance expenses limit widespread use of cutting-edge tools. Additionally, training personnel to operate complex instruments increases operational costs. This financial burden may restrict market penetration in developing regions where budgets are constrained. Limited access to affordable testing solutions can hinder innovation and compliance. Consequently, cost remains a significant challenge to broad adoption of advanced nutritional analysis technologies.

Complexity of Food Matrices

Food products often contain complex mixtures, making accurate analysis challenging. Variability in samples requires highly specialized techniques and expertise, increasing operational complexity. Certain ingredients may interfere with detection or quantification of nutrients, requiring advanced sample preparation methods. The diversity of food formulations, such as multi-ingredient and processed foods, complicates standardization. This complexity raises the risk of inconsistent results and misinterpretation. Hence, the need for continuous method development and skilled analysts is crucial but challenging for many labs.

Regulatory Variability Across Regions

Diverse regulatory frameworks in different countries create challenges for companies operating globally. Navigating these differences adds to compliance costs and operational hurdles. For example, nutrient labeling requirements vary significantly between North America, Europe, and Asia Pacific. Keeping up with frequent updates and aligning products accordingly demands robust quality assurance systems. Multinational companies must tailor testing protocols to meet multiple standards, increasing complexity and costs. Regulatory inconsistency also affects market entry strategies and product formulation decisions.

Data Management and Integration

Handling large volumes of analytical data and integrating it with other business systems can be challenging. Efficient software solutions are needed to manage, interpret, and leverage this data effectively. Many laboratories struggle with data standardization, storage, and security. Poor data integration can delay reporting and impact decision-making. There is a growing demand for comprehensive platforms that combine analytics with compliance management. Addressing these IT challenges is essential for optimizing workflow and maximizing the value of nutritional analysis.

Market Opportunity

Expansion in Personalized Nutrition

The rise of personalized nutrition based on individual health needs presents a significant growth avenue. Nutritional analysis supports customized diet plans and supplements, opening new market segments. Advances in genomics and biomarker research allow deeper insights into nutrient interactions at the individual level. Food companies and healthcare providers increasingly collaborate to develop personalized offerings. This trend promises to transform traditional nutrition and wellness paradigms. Capitalizing on this opportunity requires innovative analytical methods and tailored data solutions.

Emerging Markets Growth

Rapid urbanization and changing dietary habits in regions such as Asia Pacific and Latin America offer vast opportunities for market expansion. Increasing disposable income fuels demand for quality and safe food products. Governments in these regions are investing in food safety infrastructure and regulatory frameworks. Growing awareness about nutrition and health is shifting consumer preferences toward tested and certified products. Entry into these markets requires localized strategies and partnerships with regional testing providers. Expanding presence in emerging economies will be a critical driver for long-term growth.

Integration of AI and Machine Learning

Incorporating AI and machine learning into nutritional analysis is expected to enhance accuracy and predictive capabilities. These technologies can optimize testing processes and deliver actionable insights. Machine learning algorithms analyze complex datasets faster than traditional methods, identifying patterns and anomalies. AI-driven automation improves sample throughput and reduces human error. The growing adoption of these tools in laboratories can streamline operations and reduce costs. This integration represents a forward-looking opportunity to revolutionize nutritional testing.

Development of Portable Testing Devices

The advent of portable and on-site nutritional testing devices enables faster decision-making and quality control in food production and distribution chains. This innovation is set to drive market penetration. On-site testing reduces reliance on centralized labs, improving responsiveness. Portable devices facilitate real-time monitoring, critical for perishable goods and supply chain management. Increasing demand for rapid screening tools in retail and foodservice sectors supports this trend. Enhanced portability combined with accuracy creates new possibilities for decentralized nutritional analysis.

Market Segmentation

By Product Type

- Chromatography

- Spectroscopy

- Wet-Chemistry

- Software Solutions

By Parameter

- Protein

- Carbohydrates

- Fat

- Vitamins

- Minerals

- Heavy Metals

- Pesticide Residues

- Allergens

By Objective

- Labeling Compliance

- Quality Control

- Research & Development

- Personalized Nutrition

By Region:

- North America

- U.S.

- Canada

- Mexico

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a significant share of the nutritional analysis market due to stringent regulatory frameworks like the FDA and USDA. The U.S. dominates with advanced laboratory infrastructure and widespread adoption of innovative technologies. Canada and Mexico also contribute to growth, driven by rising food safety concerns and increased consumer awareness. Additionally, the region’s strong focus on personalized nutrition and functional foods boosts demand for nutritional testing. North American companies invest heavily in R&D, fostering market innovation. The presence of numerous testing service providers and equipment manufacturers supports a mature market environment.

Europe

Europe is a key region owing to robust food safety regulations enforced by bodies such as EFSA. Countries like Germany, France, and the UK lead the market with substantial investments in R&D and advanced analytical testing. Consumer preference for organic and clean-label products further propels demand. The European Union’s harmonized regulatory approach facilitates cross-border trade but requires compliance with strict labeling laws. Emerging trends such as plant-based foods and sustainability drive innovation in nutritional analysis. High consumer awareness and government support ensure steady market expansion across the region.

Asia Pacific

Asia Pacific is emerging as the fastest-growing region, supported by rapid urbanization and increasing disposable incomes. China, India, and Japan are major contributors, with expanding food and beverage industries and growing regulatory enforcement. The rising health consciousness in this region is fueling market expansion. Governments are strengthening food safety regulations, which increases demand for accurate nutritional testing. Increasing exports from the region also necessitate compliance with international standards. The rise of e-commerce and changing consumer lifestyles further accelerate market growth.

Latin America and Middle East & Africa

Latin America is witnessing gradual growth due to increasing food export activities and improving regulatory environments. Brazil and Argentina are notable markets with expanding food manufacturing sectors. The Middle East & Africa region is developing with increasing investments in food safety infrastructure and rising demand for nutritional testing services in GCC countries and South Africa. These regions face challenges related to infrastructure and regulatory consistency but offer promising potential. Growing consumer demand for healthier products and improved food safety measures drives ongoing market development.

Top Companies

- Eurons Scientific (Luxembourg)

- ALS Limited (Australia)

- TÜV Nord Group (Germany)

- SGS SA (Switzerland)

- Intertek Group Plc (UK)

- DTS Food Laboratories (France)

- Bureau Veritas (France)

- Mérieux NutriSciences (US)

- Thermo Fisher Scientific (US)

- AsureQuality Limited (New Zealand)

Future Outlook

- AI integration will streamline analysis processes and reduce turnaround time.

- Nutrigenomics will drive R&D demand for advanced nutrient profiling.

- Personalized nutrition will continue to fuel market innovation.

- Regulations will become more harmonized across regions.

- Automation will reduce dependency on skilled labor.

- SMEs will increasingly adopt outsourced testing services.

- Cloud-based solutions will dominate data analysis in labs.

- Startups will disrupt with faster and low-cost testing kits.

- Clean-label and organic food trends will continue to rise.

- Asia Pacific will become a focal point of global market expansion.

Read full report: https://www.credenceresearch.com/report/nutritional-analysis-market