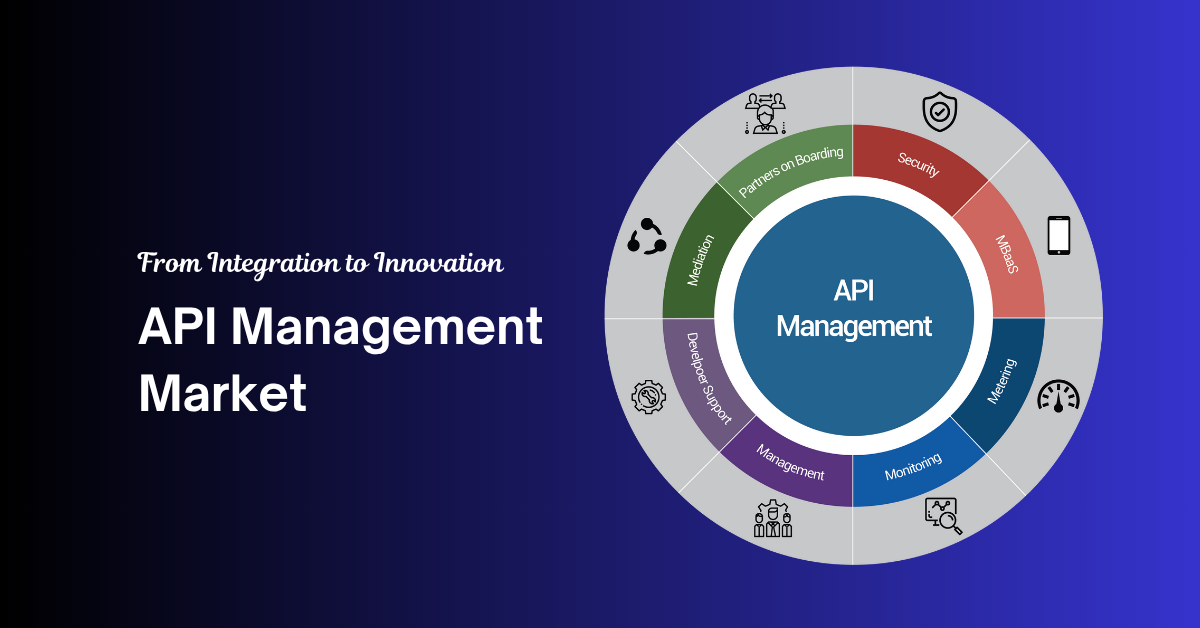

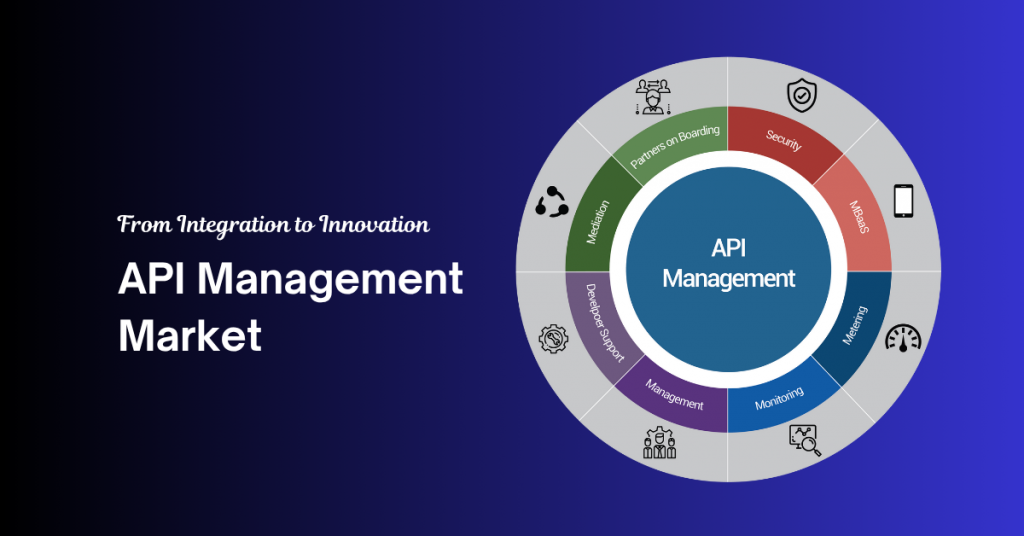

Market Overview

The API Management Market is projected to grow from USD 6,825 million in 2024 to USD 32,001.3 million by 2032, registering a robust compound annual growth rate (CAGR) of 24.7% during the forecast period. This dramatic growth is driven by enterprises’ escalating need for robust, secure, and scalable API infrastructure to support modern applications and digital integrations.

APIs have evolved from technical enablers to strategic assets, powering everything from digital wallets and telehealth portals to smart logistics and embedded finance. As businesses shift to composable architectures—where modular, reusable services are core—the need for lifecycle management, governance, and analytics is critical. API management platforms now underpin enterprise digital strategies.

In a world where omnichannel customer experiences are the norm, APIs enable seamless data exchange across mobile apps, partner channels, IoT devices, and cloud services. Security, compliance, and performance monitoring at scale remain non-negotiable requirements. Organizations investing in mature API ecosystems benefit from faster innovation cycles and reduced integration costs.

Given the ongoing digital transformation across banking, retail, telecom, healthcare, and manufacturing, API management serves as the connective tissue supporting these initiatives. As enterprises continue to reuse and expose capabilities through API-based integrations, demand for lifecycle tools will skyrocket, making this market a linchpin of digital competitiveness over the next decade.

Read full report: https://www.credenceresearch.com/report/api-management-market

Market Drivers

Digital Ecosystem Expansion & API-First Strategies

Enterprises are increasingly adopting API-first design, creating digitally composable services. API management platforms help publish, secure, and monitor these APIs across internal and external ecosystems. Developers gain tools that accelerate provisioning, testing, and deployment. Automated SDK generation and self-service access reduce friction for partners. Organizations using API-first approaches can pivot faster in competitive landscapes.

Accelerating Cloud-Native Applications

Cloud adoption continues to rise as businesses shift workloads to AWS, Azure, and Google Cloud. API gateways and management tools ensure secure, standardized traffic flow between cloud-native services. These tools handle authentication, encryption, and traffic rules across microservices. With APIs as entry points, cloud security and compliance are reinforced. Faster cloud migrations drive API platform adoption.

Regulatory & Compliance Requirements

Industries like finance, healthcare, and public services are regulated by frameworks like PSD2, HIPAA, and FHIR. API management platforms help enforce consent, logging, encryption, and audit capabilities. Role-based access and token policies ensure secure data transactions. Audit-ready reporting tools satisfy compliance teams. As regulations evolve, API platforms provide agility in policy enforcement.

Partner & Developer Ecosystem Enablement

Companies are launching external developer portals and partner API programs. API management supports onboarding, usage plans, quota enforcement, and monetization. These platforms also provide usage analytics and help track partner engagement. Transparent documentation and sandbox environments empower third-party innovation. Ecosystems built on secure APIs drive business growth.

Market Challenges

Complexity of API Lifecycle Management

Managing APIs from design to retirement is complex, especially across multicloud and hybrid environments. Coordinating updates, version control, and backward compatibility requires robust governance frameworks. Without integrations to CI/CD pipelines, manual stages can slow delivery. Lack of centralized visibility impedes disaster recovery planning. API sprawl can reduce maintainability and introduce security risks.

Security Gaps and Policy Enforcement

Ensuring consistent policy enforcement across thousands of APIs is challenging. Some APIs may bypass gateways, leading to risk exposure. Centralized policy engines are needed to maintain compliance. Real-time threat detection requires machine learning and behavioral analytics. Misconfigured APIs can expose sensitive data. Adversaries may exploit outdated or deprecated endpoints.

Skill Shortages & Operational Overhead

Many organizations lack experienced API architects and developers. Managing complex API ecosystems requires cross-functional skills. Training staff on secure coding, analytics, and governance consumes time and budget. Smaller teams may struggle with platform management. Relying on external consultants increases dependencies. The talent gap hinders effective rollout and scaling.

ROI Measurement & Justification

Demonstrating clear ROI from API investments can be difficult. While platforms enable faster time‑to‑market, direct revenue attribution may be unclear. Organizations struggle to measure savings from developer efficiency or ecosystem growth. Initial setup and maintenance costs must be tracked against long-term benefits. Lack of clear KPIs can delay executive buy-in and funding.

Market Opportunity

Monetization Through API-as-a-Product

Organizations can transform internal APIs into revenue-driving products. Charging for premium access, usage over quotas, or tiered service levels creates new income streams. Industries like finance, healthcare, and logistics are pioneering this model. APIs become commercial assets, not just integration tools. Monetization drives deeper API productization strategies.

Hyperautomation through API Orchestration

APIs can orchestrate workflows across tools like BPM, ERP, RPA, and analytics platforms. This unlocks hyperautomation—streamlining approvals, compliance checks, and customer journeys. Central policy enforcement ensures secure data flow. API orchestration reduces repetitive tasks and human error. Businesses gain agility and operational efficiency.

Integration with Industry-Specific Platforms

Vertical industries are building domain-specific API ecosystems—like FHIR for healthcare and ISO 20022 for banking. API management ensures compliance and standardization across these platforms. Organizations can share capabilities like patient records or payment services more securely. This verticalization increases trust and collaboration. Standard APIs accelerate vertical adoption.

Intelligent API Observability & DevOps

Next-gen API platforms integrate observability into DevOps tools. They offer real-time dashboards, distributed tracing, and service maps. Developers pinpoint performance issues quickly and streamline debugging. Integration with CI/CD enables auto-deployment of new endpoints. This reduces MTTR and accelerates innovation cycles. Observability becomes a competitive advantage.

Market Segmentation

Based on Component

- Solutions

- Services

Based on Deployment

- On-premises

- Cloud

Based on Organization Size

- Large Enterprises

- Small and Medium Enterprises

Based on End User

- Banking and Financial Institutions

- Retail

- IT and Telecommunications

- Consumer Goods

- Others

Based on Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK, France, Germany, Italy, Spain, Russia, Belgium, Netherlands, Austria, Sweden, Poland, Denmark, Switzerland, Rest of Europe

- Asia Pacific

- China, Japan, South Korea, India, Australia, Thailand, Indonesia, Vietnam, Malaysia, Philippines, Taiwan, Rest of Asia Pacific

- Latin America

- Brazil, Argentina, Peru, Chile, Colombia, Rest of Latin America

- Middle East & Africa

- GCC Countries, South Africa, Rest of Middle East and Africa

Regional Analysis

North America

North America dominates API management thanks to early cloud/platform adoption and enterprise-grade infrastructure. The U.S. drives API-centric strategies across fintech, healthcare, and smart cities. Canada’s public institutions leverage open APIs for transparency, while Mexico’s fintech growth centers on mobile banking APIs. Robust venture capital funding and developer ecosystems accelerates innovation and adoption across industries.

Europe

API adoption across Europe is shaped by compliance—GDPR, PSD2, Digital Identity frameworks. The UK, Germany, and France lead financial API rollout and open banking networks. Nordic countries leverage APIs for secure digital ID and public health services. Developer communities are robust in Amsterdam, Berlin, Paris, fostering open-source API innovations. GDPR acts as both a challenge and competitive advantage.

Asia Pacific

APAC is a fast-growing API market, propelled by digital transformation in China, India, and Southeast Asia. Super-apps like WeChat rely heavily on internal APIs to connect services. India’s government-backed API programs like DigiLocker and Unified Payments Interface are catalysts for adoption. Southeast Asian nations are embracing open banking and embedded fintech. Government-backed smart city and public service APIs accelerate infrastructure.

Latin America

Latin America’s API momentum is driven by financial inclusion and open banking mandates. Brazil-led reforms have inspired Argentina, Chile, and Mexico to build API gateways for public and private sectors. Banks and telcos use APIs for cross-border services and mobile payments. Cloud infrastructure and US-based provider partnerships accelerate rollout. Developers thrive in fintech and e-commerce communities.

Middle East & Africa

API growth is strong in the Middle East, propelled by smart city initiatives in the UAE and Saudi Arabia. Government and public services use APIs for identity, traffic, and utility management. Africa’s API-led innovation is driven by mobile money ecosystems like M-Pesa and emerging API infrastructure in Kenya and Nigeria. Regional incubators and partnerships between telcos and banks are accelerating usage.

Top Companies

- Rapid API (US)

- Torry Harris Business Solutions (India)

- Tyk Technologies (UK)

- Nevatech, Inc. (Canada)

- DreamFactory Software, Inc. (US)

- Salt Security, Inc. (US)

- Postman, Inc. (US)

- Gravitee Topco Limited (France)

- Kong Inc. (US)

- Sensedia (Brazil)

- Stoplight (US)

Future Outlook

- Enterprises will enhance API ecosystems with AI, enabling automated anomaly detection and optimization.

- Hybrid cloud-native API platforms will support cross-environment deployments at scale.

- Distributed API governance will become essential for microservices and edge use cases.

- Increased integration of low-code capabilities will accelerate citizen developer adoption.

- API monetization strategies, including marketplaces and revenue-sharing, will gain traction.

- Industry-specific API standards (e.g., FHIR, PSD2, e-invoicing) will proliferate.

- Observability-first API platforms will reduce MTTR and improve reliability.

- Edge-native gateways will support real-time use cases in telecom, automotive, and healthcare.

- Open-source API management solutions will increase adoption in hybrid environments.

- Strategic API partnerships and ecosystems will shape competitive advantage globally.

Read full report: https://www.credenceresearch.com/report/api-management-market